Data suggests that the addition of Call of Duty into Xbox Game Pass could indeed be a so-called “tipping point” that pushes Microsoft into the market leader position for multi-game subscriptions by revenues.

VIEW GALLERY – 12 IMAGES

Microsoft recently published a response to the concerns raised by the UK’s Competition and Markets Authority (CMA) regarding merger with Activision. The trillion-dollar corporation makes an interesting claim as part of the response, saying that acquiring Call of Duty won’t ‘tip subscription services in Xbox’s favor.” Data suggests otherwise, however.

We’ll be focusing just on Call of Duty, however other series like Diablo and Overwatch (both of which are billion-dollar franchises) will add further compounded value to the Game Pass subscription.

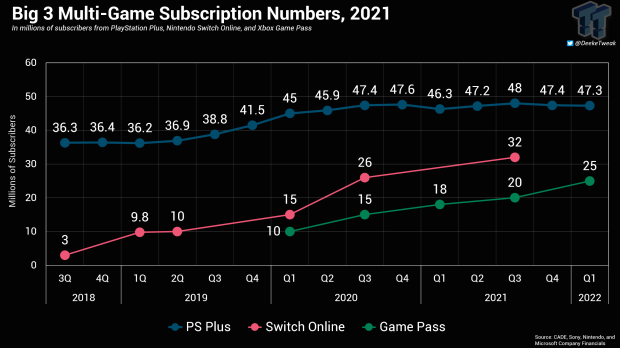

First let’s do a quick recap on how much money that each platform-holder makes from their multi-game subscriptions.

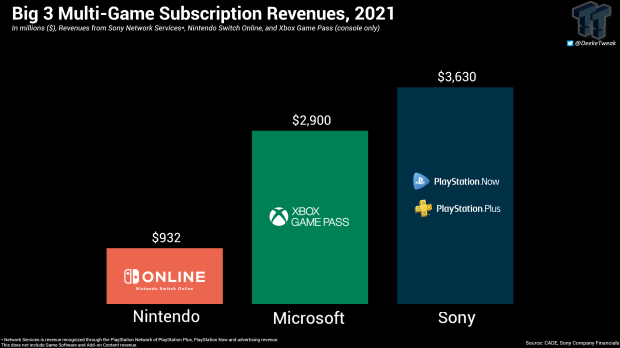

According to data published by Brazil’s CADE regulators and information made publicly available by Sony, Microsoft, and Nintendo, the Big 3 made over $7.4 billion from combined subscription revenues in 2021.

The breakdown looks like this:

- PlayStation Plus + PlayStation Now – $3.63 billion

- Xbox Game Pass (console only) – $2.9 billion

- Nintendo Switch Online –$932 million

Subscription earnings from gaming’s big 3 platform-holders, PlayStation, Microsoft, and Nintendo.

We’ve also compared how subscription revenues fit in with total company earnings for the 2021 period.

Combined, the Big 3 made $51.5 billion in total revenues in 2021. Subscription services made up roughly 14% of these revenues.

Big 3 revenues, 2021

- Sony – $24.6 billion

- Microsoft – $16.28 billion

- Nintendo – $14.35 billion

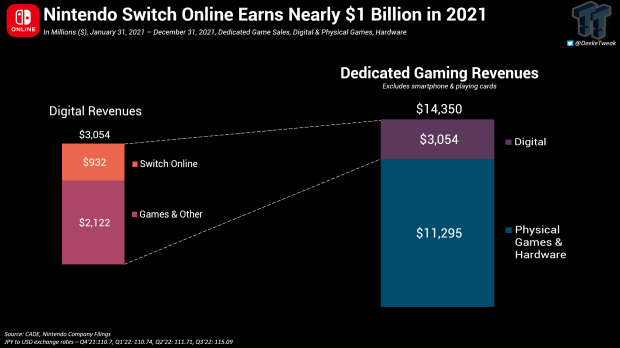

Nintendo Switch Online revenues, 2021.

Read Also: Nintendo Switch Online made nearly $1 billion in 2021

Switch Online: $932 million revenues on 32 million total subscribers throughout 2021 on a platform that is primarily focused on software sales. Switch Online is entirely additive to Nintendo’s business and is not disruptive enough to skew Nintendo’s revenues towards digital. Switch Online made 31% of Nintendo’s total digital revenues through 2021 ($3.054 billion) and just 8% of Nintendo’s total gaming earnings ($14.35 billion).

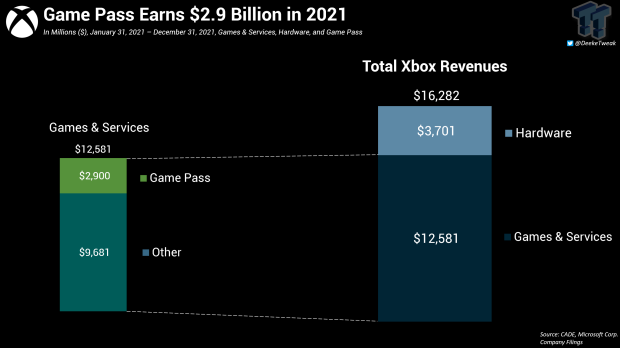

Xbox Game Pass revenues, 2021.

Read Also: Microsoft reveals how much money Game Pass actually makes

Xbox Game Pass: $2.9 billion in revenues in 2021, not including PC. Game Pass is a material contributor to Microsoft’s video games business, making up nearly 18% of total Xbox gaming revenues for 2021 ($16.28 billion) and a nearly 30% of the company’s total games & services revenues ($12.581 billion).

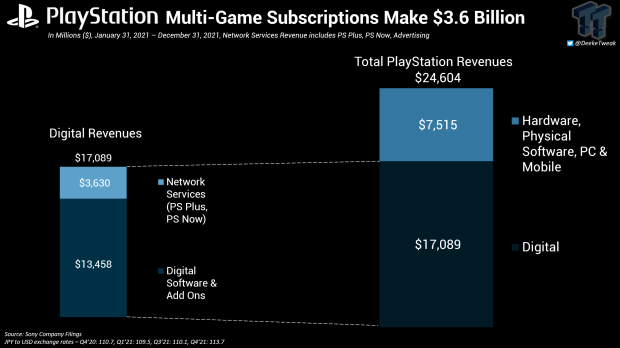

PlayStation Plus + PlayStation Now subscription revenues, 2021

PlayStation: Sony’s games subscription revenues are nestled in its Network Services segment, which combines PlayStation Plus, PlayStation Now, and advertising revenues together. We don’t know the exact split or share of subscription revenues against advertising revenues, but we can say the Network Services segment made $3.63 billion throughout 2021, compromising 21% of Sony’s total digital video games earnings ($17.08 billion) and nearly 15% of its total video games segment revenues for 2021 ($24.6 billion).

As I pointed out in previous coverage, we can see the gap between PlayStation subscriptions and Xbox Game Pass is only $700 million. This is an important figure and it serves as the main point of this article.

Xbox Game Pass is only $700 million off from PlayStation Plus and PlayStation Now subscriptions, assuming both subscriptions make up the totality of Sony’s Network Services segment (which they do not).

These Game Pass earnings figures also do not include revenues from PC, which, according to Brazilian regulators at CADE, makes up 60-70% of the PC multi-game subscription market.

This means that the gap between Xbox Game Pass and PlayStation Plus revenues is actually closer than previously believed. CADE’s own investigations show that Sony has 40-50% of the console multi-game subscription market, with Microsoft holding 30-40% of the market.

So what does this tell us?

Big 3 subscription numbers: Switch Online (32 million), Game Pass (25 million), and PlayStation Plus (47.3 million).

While Sony is in the lead right now insofar as actual subscribers, with its powerful 47.3 million-strong PlayStation Plus subscription, as compared to Microsoft’s 25 million-strong Xbox Game Pass service, the revenue difference between the two subscriptions may not be as wide as the revenue difference between the two company’s total earnings (Microsoft’s $16.28 billion vs Sony’s $24.6 billion).

It’s also interesting to note the combination of Activision-Blizzard’s and Microsoft’s 2021 revenues would exceed that of Sony’s 2021 earnings, making the unified company technically ahead of console gaming’s market leader.

Activision made $8.8 billion net revenues in 2021, and Microsoft’s Xbox made $16.28 billion–the total sum would be $25.08 billion, exceeding Sony’s $24.6 billion.

Now that we know the extent of subscription numbers and revenues, and that Game Pass isn’t that far away from PlayStation subscription earnings, let’s take a look at Call of Duty’s overall value.

In its response to the CMA Phase 2 decision brief, Microsoft said this:

“…Nor is there any basis for the idea that acquiring Call of Duty could ‘tip’ subscription services in Xbox’s favor.”

The key to understanding if this is potentially true lies in two things: The gap between Game Pass and PlayStation subscriptions, which we have outlined above, and Call of Duty’s overall estimated value.

According to previous reports, Call of Duty has made over $30 billion in lifetime revenues from 2003 to present, including full game sales, microtransactions, and all other points of sale and monetization tactics.

Call of Duty games made a record-breaking $3 billion in 2020 on the strength of the free-to-play Warzone game, alongside the mainline release of Black Ops Cold War across two console generations.

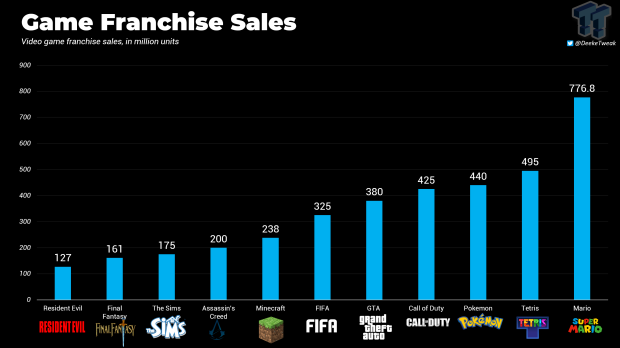

Call of Duty has sold 425 million games so far.

The series has sold over 425 million games worldwide as of June 2022, and is the fourth best-selling video game franchise in the history of the industry.

Activision-Blizzard has also sold 25 million Call of Duty games in one year.

These are just some of the figures highlighting the franchise’s massive success and impact throughout the industry.

We have to look deeper, though. To get a better understanding we need more context and data. Luckily Activin-Blizzard has provided us with more figures.

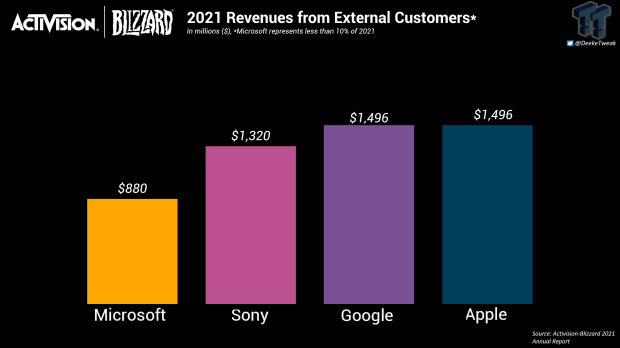

In Activision-Blizzard’s 2021 annual report, the company outlines how much money it made from platforms run by Microsoft, Sony, Apple, and Google.

The publisher made $8.8 billion in net revenues in 2021.

In 2021, Microsoft platforms generated less than 10% total Activision-Blizzard revenues. The leading contributors to earnings were, in order of greatest to least, were Apple and Google with 17% of net revenues (or $1.496 billion each), Sony with 15% of net revenues (about $1.32 billion), and Microsoft with less than 10%, which equates to less than $880 million.

This is before Activision-Blizzard games show up on Microsoft’s Xbox Game Pass ecosystem both on console and PC. Microsoft has said that it desires to bring Call of Duty as well as other major franchises to Game Pass.

By way of perceived additive value, it could be said that Call of Duty, one of the biggest video game franchises in the world’s most lucrative entertainment industry, could spark Game Pass subscription sign-ups while fostering retention.

The sheer staying power of the Call of Duty franchise, whether it be through evergreen games released generations ago, or new titles released day-and-date on Game Pass, is likely to help grow subscribers.

The weight of the numbers we have described in terms of revenues, market reach, and overall sales, is something to keep in mind.

It’s also worth mentioning that the Microsoft-Activision merger precedes one of the most significant expansion points in Call of Duty’s billion-dollar history.

Warzone is the most important thing Activision-Blizzard has ever done. Warzone links mainline Call of Duty games together while offering a standalone and separate monetization point. Warzone was part of Activision’s four-part plan, which is accelerating greatly with Modern Warfare 2.

The release of Modern Warfare 2 will kick off a new era for the franchise. There will soon be five separate Call of Duty products on the market. All of these products will have their own separate monetization points that also unify mainline games together, making Call of Duty into a kind of ecosystem rather than a franchise.

- Modern Warfare 2 (mainline game, monetized)

- Warzone 2.0 (free-to-play, monetized)

- Warzone Mobile (free-to-play, monetized)

- Warzone 1.0 (free-to-play, monetized)

- Call of Duty Mobile (free-to-play, monetized)

The significant value of offering Call of Duty games in an all-you-can-play, total-access bundle via Game Pass can’t be underestimated. These older games are still apparently selling well and all retain DLC, map packs, and microtransaction spending points as well.

if Microsoft was making up to $880 million without Call of Duty being on Xbox Game Pass, then how much could it make with the inclusion of Call of Duty? It’s hard to say for sure, but based on the volume of new Call of Duty content made previously available, and the amount of content across multiple monetization points that’s about to hit the market across consoles and PC, and the continued expansion and evolution of the franchise into a kind of ecosystem of products, we can confidently say that the franchise will have a material impact on Game Pass subscriptions and adoption if it enters the subscription ecosystem.

Activision started a grand unification strategy in 2018.

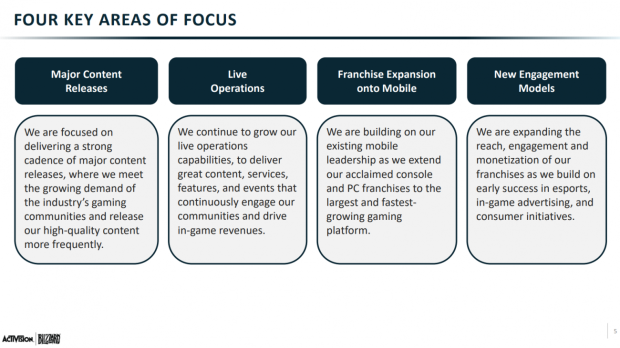

The new Call of Duty ecosystem is driven by Activision-Blizzard’s four-part plan, which was introduced in 2018, the same year it made over $7.5 billion and simultaneously fired 800 non-game developers from its staff.

The plan focuses on these main pillars:

- Mainline game releases

- Live operations

- Mobile games

- New engagement models

Over the next six months, Call of Duty will be unified across all of those touchpoints. Modern Warfare 2 will serve as the mainline release with live ops; Warzone 2.0 is live ops and a culmination of the new engagement model; and Warzone Mobile is the mobile game version that will wrap everything together in a cohesive package.

It’s entirely possible that all of these things will affect Game Pass in totality, as well. If Microsoft offers mobile games through its Game Pass subscription, or some sort of additional content in Candy Crush or Warzone 2.0 for Game Pass subscribers, then it could further add value to the subscription itself.

As we’ve outlined above, Call of Duty is a powerful force in gaming that is rapidly expanding across the same vectors that Microsoft is (and has been) targeting.

Game Pass is designed to make players “sticky” in the ecosystem by way of added value, discovery, and investment of both money and time.

Game Pass is unique in that all game types synergize well with the service, whether they be premium games or live games.

Microsoft’s Phil Spencer has already confirmed that Game Pass itself is a catalyst for increased game sales:

“There’s two stats that always surprise me. One: I think on a monthly average a Game Pass player plays 4 or 5 more games than a non-Game Pass player. They’re playing a lot more games. They’re also buying more games…which at first I’m like…that surprised me,” Spencer said in a 2018 interview with Giant Bomb’s Jeff Gerstmann.

Live service games also help Game Pass by simple virtue of their never-ending gameplay loops and incentivizing in-game purchases. Live games require significant time investment, and if the gameplay is tied to a recurring subscription like Game Pass, users are more likely to keep the subscription active in order to keep playing.

In November of 2018, former analyst firm SuperData found a direct link between subscriptions and in-game spending. The firm notes that subscribers were more likely to spend on in-game items.

“SuperData estimates that subscribers spend 45% more for games upfront than non-subscribers, and twice as much on in-game content when compared to non-subscribers. Cosmetics, Season Passes, and Battle Passes are the most popular in-game purchases among subscribers,” the company wrote.

Based on the data, information, and insight we have highlighted in this article, Call of Duty is very likely to trigger the so-called subscription “tipping point” to Microsoft’s favor.

Be the first to comment