Christian Petersen/Getty Images News

NOTE From Author: This article was written before the Bungie acquisition by Sony.

The Thesis

The market has reacted negatively to the recent acquisition of Activision Blizzard (NASDAQ:ATVI) by Microsoft (NASDAQ:MSFT), plunging Sony (NYSE:SONY) stock by more than 10%. Ironically, investors should have seen this gaming domination strategy by Microsoft coming as the giant has been on an acquisition spree in recent years, acquiring the likes of Zenimax media a year earlier.

However, the effects of these acquisitions are not hurting Sony’s PlayStation much. Despite Microsoft gaining market ground, the PlayStation 5 is already the fastest selling console in history. That’s because the PlayStation brand has a number of competitive strategies in its arsenal that are being supported by its flagship product, the PlayStation 5.

I believe there’s another way to look at the Sony vs. Microsoft gaming wars: through the lens of David and Goliath. Sony represents David, an on-the-surface weaker opponent to Goliath, a strong giant with the best weapons and armor. In the end, David defeats Goliath. Though a dramatization of reality, I believe Sony is being viewed as a weaker opponent, despite having a number of opportunities for market leading positions.

In turn, I believe Sony, through its gaming and network services segment, has stronger future business potential than investors choose to think. When the supply is finally able to meet the demand of the console, I believe Sony will experience greater growth in this segment. Firstly, through the growth in the PlayStation 5, and later, through a lagging effect on its subsidiaries, which I call stones.

All in all, while Microsoft follows a strategy of acquired growth in its gaming segment, Sony is following one of organic growth – a strategy I believe will lead to longer lasting revenue growth rates and profitability.

The Story Of David And Goliath

You may be wondering what an old biblical fable has to do with the ongoing gaming wars between Microsoft and Sony. Well, grab your popcorn, because this one’s interesting.

A quick recap of David and Goliath follows the Philistines attacking the Israelites around the 11th century, BC. One Philistine, named Goliath, was the army’s main warrior, challenging any opponent to face him. The Israelites cowered to accept the challenge because he was bigger, taller and stronger than anyone else in the war. Plus, his armor and weaponry were unmatched, boasting the best sword, shield and spear.

One Israelite, a young shepherd boy named David, was fearless, citing his faith in God to defend himself and Israel. The King of Israel endorsed David’s bravery and gave him his armor, but it did not fit. Instead, David grabbed five smooth stones and a sling, put them in a bag and went to face Goliath.

When Goliath saw David, he laughed. Taking advantage of this, David ran towards Goliath and quickly threw a stone with his sling, hitting Goliath’s forehead, causing him to fall to the ground. Goliath was defeated, without armor, without proper weaponry, but with precision and confidence.

In the context of our analysis, Sony’s PlayStation represents David, a personality without the armor (money) or weaponry (Game Pass), but upmost confidence and precision. Microsoft’s Xbox represents Goliath, a giant with strong armor and weaponry.

With 4 well-equipped stones and a slingshot (PlayStation), Sony will drive future revenue growth and profitability through its core revenue driver, the gaming and network segment.

Goliath (Microsoft) The Cash Cow With Powerful Weapons And Armor

Microsoft can liquidate its short term investments tomorrow and couple it with its existing cash on hand to have over $130 billion in cash (based on FY 2021) to spend on acquisitions. On the other hand, by doing the same thing, Sony only has $5 billion in cash, even with its short term investments considered.

Let’s face it, if we are competing on who’s got the bigger stockpile of cash to expand their gaming systems, Microsoft wins over and over again. They can (and have recently) go on a shopping spree, buying major triple-A gaming studios. Recent acquisitions include ZeniMax, the parent organization of gaming giant Bethesda for $7.5 billion, and Activision Blizzard for a whooping $68.7 billion dollars.

Microsoft Acquisition of ZeniMax Media Microsoft Acquisition of Activision Blizzard

Microsoft now has an additional 17 subsidiaries under its belt, 8 from ZeniMax and an additional 9 from Activision blizzard. In total, Microsoft now owns 32 publishers. That’s a lot to bring to Xbox Game Pass and a lot more to compete with for Sony. However, Sony’s PlayStation is not out of the fight.

David (Sony) The Shepherd, Caring To Its Flock (PlayStation)

PlayStation and its segments is the strongest revenue driver for Sony, slowly gaining the bulk of its core revenue generators.

Game And Network Services Segment Breakdown

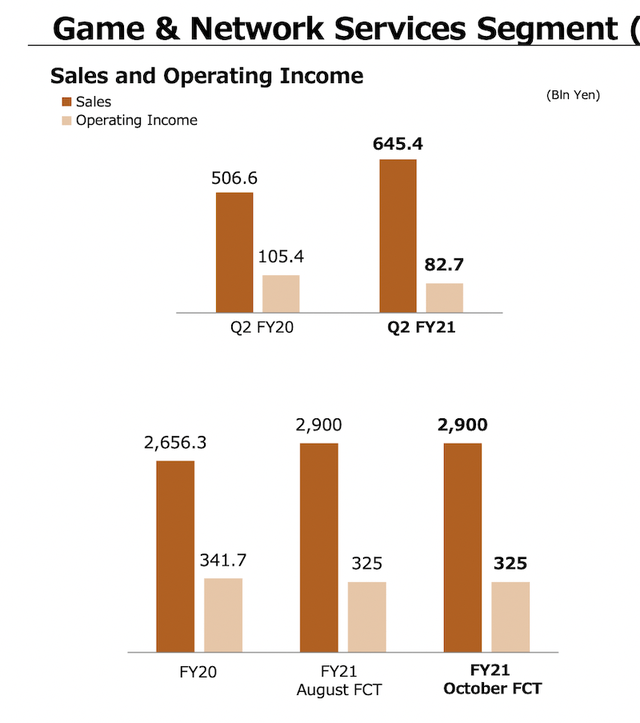

The game and network services accounted for 52.7% of total revenues in its latest report, Q2 2021.

Revenue

For the 3 months ended September 30, the game and network services segment’s revenue reached ¥645.4 billion ($5.7 billion USD) from ¥506.6 billion ($4.39 billion USD) during the same period in 2020, representing a 29.8% increase in sales. Total revenue reached ¥1.2 trillion ($10.8 billion USD). This increase in revenue for the segment was largely attributable to the increase in PS5 hardware sales during the period, a change in favorable currency mix, and to a lesser extent, sales of third party titles.

| Revenues Breakdown |

Q1 2021 (in billions) |

Q2 2021 (in billions) |

| Game and Network Services Segment (US dollars) | 4.2 | 5.7 |

| Growth rate (%) | — | 29.8 |

Hardware Sales

For the same period, hardware sales reached ¥160 billion ($1.8 billion USD) from ¥120.6 billion ($1.04 billion USD) during Q1 2021. One analyst, claims that the PlayStation 5 hardware units sold reached 3.3 million this quarter, up from 2.3 million in Q1 2021. This means console units sold reached 13.4 million by September 30,2021.

| Hardware Breakdown | Q1 2021 (billions) | Q2 2021 (billions) |

| Revenues (US dollars) | 1.04 | 1.8 |

| Growth rate (%) | — | 73.1 |

| Hardware Breakdown | Q1 2021 (units in millions) | Q2 2021 (units in millions) |

| Unit Sales | 2.3 | 3.3 |

| Growth rate (%) | — | 43.5 |

Revenues in the hardware sales segment grew by 73.1% from Q1 2021 to Q2 2022 while unit sales grew by 43.5% . While both are high, I believe this number underestimates the actual demand for the console. The system is still in short supply, but we will discuss this in more detail later.

Software Sales

Software sales reached ¥343 billion ($3 billion USD) by Q2 2021. This is slightly up from the ¥346.03 billion ($2.9 billion USD) in Q1 2021. However, it is a 3.6% increase from Q2 2020’s level of ¥330.99 ($2.8 billion USD) in Q2 2020.

| Software Sales Breakdown Quarter Over Quarter |

Q1 2021 (in billions) |

Q2 2021 (in billions) |

| Revenue (US dollars) | 2.9 | 3 |

| Growth Rate (%) | —- | 3.6 |

| Software Sales Breakdown YoY | Q2 2020 | Q2 2021 |

| Revenue (US dollars) | 2.8 | 3 |

| Growth Rate (%) | — | 6.6 |

Physical software sales were ¥28.15 billion ($244 million USD) in Q2 2021, which is down 20.5% from ¥33.93 billion ($294.2 million USD) in Q2 2020. However, it is up roughly 10% from Q1 2021’s ¥25.6 billion ($222 million USD).

| Physical Software Sales Breakdown Quarter Over Quarter |

Q1 2021 (in millions) |

Q2 2021 (in millions) |

| Revenue (US dollars) | 222 | 244 |

| Growth Rate (%) | — | 10 |

| Physical Software Sale Breakdown YoY |

Q2 2020 (in millions) |

Q2 2021 (in millions) |

| Revenue (US dollars) | 294.2 | 244 |

| Growth Rate (%) | —- | -20.5 |

Digital software sales were ¥126.69 billion ($1.1 billion USD) in Q2 2021, in line with Q2 2020’s report of ¥125.51 ($1.09 billion USD), but up 10% from Q1 2021’s level of ¥114.3 billion ($991 million USD).

| Digital Software Sales Quarter Over Quarter |

Q1 2021 (in millions) |

Q2 2021 (in billions) |

| Revenue (US dollars) | 991 | 1.1 |

| Growth Rate (%) | — | 10 |

| Digital Software Sales YoY |

Q2 2020 (in billions) |

Q2 2021 (in billions) |

| Revenue (US dollars) | 1.09 | 1.1 |

| Growth Rate (%) | —- | negligible |

All in all, software sales seem to be stagnant. Though, there is a trending shift from physical software sales to digital software sales.

Physical sales are down 20.5% YTD, while digital seems to be in line with its previous year’s level. However, both channels are up 10% from their Q1 levels. I have more hope for the digital channel though. More gamers are enjoying the convenience of downloading games, fueled by better broadband and internet speeds. Therefore, I expect the physical channels to continue decreasing YoY, while the digital channels benefit from the shift.

Operating Income

Operating income decreased from ¥105 billion ($911 million USD) reported in September, 2020 to ¥82.7 billion ($716 million USD) during the same time in 2021. This represents a 27% decrease. The operating income segment here decreased for a number of reasons:

- deterioration of operating results for hardware and peripheral devices

- unit sales decreases for PlayStation 4 hardware and peripheral devices

- Strategic price point losses for PlayStation 5 from setting price point below manufacturing cost

- decrease sales of first party titles

- notable increase in SG&A related to PlayStation 5 sales

GNS Operating Income breakdown

PlayStation has confidence. I make this claim because its brand is representative of the content it produces; frequent quality games that define its personality. Okay, but we know from the story of David and Goliath that confidence isn’t enough. David had 5 stones and a slingshot to execute his plan. So let’s see what PlayStation’s got.

The Stones

Sony’s PlayStation has 4 stones (weaponry/advantages) it will use. These stones will allow Sony to drive growth in its primary revenue driver, gaming network and services, as it slingshots Xbox out of its way.

Stone 1: PlayStation Studios

Where Microsoft has “Halo’s” 343 Industries and “Gears Of Wars'” The Coalition, Sony has “The Last Of Us'” Naughty Dog and “Horizon’s” Guerrilla Games. You see, Sony might not have 32 titles under its belt, but all of its studios under the PlayStation Studios’ brand represents something greater; something different.

“The Last Of Us Part 1” and “2” are regarded as some of the greatest games ever made. Microsoft even admitted this, for part 2 specifically, citing in a leaked internal report that it was significantly ahead of its time on both console and PC. Furthermore, the game has received over 200 game of the year awards, significantly higher than the majority of anything Xbox produces.

I don’t think I even need to mention the reception from Santa Monica’s “God of War” or Insomniac Games’ “Spiderman series” to speak for the quality that PlayStation outputs.

The more incredible feat is that each brand represents something unique about PlayStation. “The Last Of Us” represents Sony’s take into the human condition; what makes us all fall. “Spiderman”, “Horizon” and “Ratchet and Clank” represent heroic storytelling and adventure. “Returnal” represents arcade styled gameplay and failure (never giving up).

You see, our Goliath can have 32 triple-A titles under its belt, but it’s simply not outputting the quality that PlayStation brings about. PlayStation has passion and confidence, something you see through the quality and reception of their games through the PlayStation Studios platform.

Value Effect On The Segment

We know from the Q2 2021 report that first party title sales have decreased. This is logical considering PlayStation Studios’ hasn’t released a first party title since “Returnal”. However, there are a number of upcoming titles, including a new “Horizon” game in February and a new “God of War” rumored for this this year.

To keep things in context, according to a twitter leak, “Horizon’s” first game, “Zero Dawn” brought in approximately $400 million USD on 8 million copies sold. In addition, God of War brought in $500 million USD on 10 million copies.

So what’s the value effect?

Let’s assume that “Horizon” matches its original games’ sales, roughly 700,000 copies in its first month at a price point of $70 USD a unit. That’s $49 million in revenue added before the next quarter on just one game, and based on a conservative estimate.

I further expect the sales of these near term-titles to boost all segments of gaming and network services, with the most immediate effect on revenues in the digital sales channel, driving up those first party title margins. Then, I expect there to be a lagged effect on PlayStation 5 hardware sales as more people become incentivized to play these games, assuming supply is matching demand by “God of War’s” release.

In the long term, Sony’s CFO has already said they are aggressively investing in the development of their first party titles. “We intend to increase development personnel and other in-house costs by approximately $183 million USD year over year”. Therefore, I expect these investments to yield longer higher-quality and longer lasting games in the future.

Stone 2: Haptic Feedback Controller

Have you tried the PlayStation 5’s controller yet? If not, I highly recommend you do.

The haptic feedback controller brings another dimension to gaming, something simply not seen on Xbox or PC. Shooting a weapon or pulling a bow feels completely reimagined. Furthermore, it is a strong driving point for PlayStation 5’s differentiation from Xbox Series X.

It works by providing realistic tension using a specialized gear motor in the R2 and L2 triggers. Current flows through the gears, adding and releasing pressure as the user engages the triggers.

PS5 Haptic Feedback controller

Simply put, the haptic feedback controllers offer another dimension to gaming that fuels stone 1. In terms of stone 1, it adds a driving point to enhance the gameplay experience of these narrative-driven games, offering another dimension of immersion and gameplay.

Value Effect

This is a strong driving point for the PlayStation 5 hardware sales. The controller, by itself, is priced at a target of around $70 USD retail. That’s just as much as one game. Other than being a driving force for PlayStation 5 hardware sales through a new gameplay experience, it stands alone as its own growth asset.

The system only comes with one controller. Thus, by itself it acts as an incentive to buy more to play with friends or family. However, many gamers will buy additional controllers because PlayStation is launching a number of colors surrounding the controller.

These colors help the controller stand out as more than just a controller; instead acting as an extension of both the PlayStation brand and the personality of the gamer. This can be supported by looking at the colors they just released.

A light blue, pink and purple controller are seen in the new advertising, reflecting PlayStation’s stance of standing out amongst the crowd. In addition, they are releasing matching PlayStation 5 covers, which will pair nicely with the new controller.

Stone 3: PlayStation Now

PlayStation Now is Sony’s take at Xbox Game Pass, though on a much smaller scale. Unfortunately, its user interface and content simply doesn’t match Game Pass’ standard but that can all change.

The platform hosts a measly 3.2 million active users, much smaller than Game Pass’ 25 million. However, this number has doubled from 2020, showing a clear vertical that Sony can take to drive additional channels of growth.

Its other segment, PlayStation plus, boasts 47.6 million users, so it’s not the case that it has a smaller user base or that its users spend lower on average than Xbox. Simply put, PS Now feels secondary to its growth strategy.

If PlayStation can launch something with a sleek user interface, launch its PlayStation Studios titles on it and drive its platform at a price point similar to Xbox, I believe it has a real chance.

Remember, this isn’t a problem of content, PlayStation has that in terms of quality. Rather, its execution. If I learned anything from PlayStation, it’s that their execution with games is unmatched, and if they just poured effort here, it can really turn things around.

Value Effect

An updated PS Now will act as a new driver to increase its revenue growth through hardware and digital sales channels. Like Game Pass, if executed correctly, it will act on its own to drive demand in the PlayStation 5. Look at it this way. Most new people are buying Xbox’s because of Game Pass, as it offers a great incentive to spend less in the long term.

A similar platform will drive revenue growth through a predictive ongoing subscription channel, one in which it can showcase its new games and increase the sales of its add-on content. Add-on content grew 9.5% compared to Q2 2020, representing $1.6 billion in revenue generation. Thus, it’s an easy channel for Sony to exploit in this updated PSNow strategy.

We know something is coming. A CNBC report shows that Sony executives said they will spend $18.39 billion USD over the next 3 years on strategic investments, including a push to expand subscribers to its gaming channels. I expect this to be an updated PS Now or something similar to finally enter the subscription business.

Stone 4: PlayStation 5’s User Interface, PlayStation Store and PlayStation+

PlayStation 5’s user interface boasts a combination of simplicity and usability. Its UI is focused by offering exactly what gamers want to see most, games. This is completely different from Xbox’s strategy of keeping its Xbox one user interface intact, a lower standard UI in my opinion.

As you can see in the image below, PlayStation 5’s games are at your fingertips the second you turn it on. This was always a favorite choice of design amongst PlayStation 4 users and I’m happy that they took it a step further. Furthermore, the vibrant displays of colors and sounds present an immersive feeling that leverages the PlayStation brand against its flagship product.

Both the App Store and PlayStation Plus platform is built into the system, offering an instantaneous display once the user hovers over the app. The image above actually has the cursor over the PlayStation store, showing store titles right below (a neat feature). This does two things. Firstly, it keeps in line with their strategy of offering access to games at your fingerprint, allowing users to quickly discover what’s new in the world of gaming.

Secondly, its allowing users to more quickly purchase games and subscriptions. Today, the world is impatient. People want things instantly, especially gamers. Providing quick and easy access to the games users want to play is a sure-fire way to increase revenues. PlayStation stores’ revenues are an important driver in the overall games and network sales segment.

Value Effect

Other than an obvious hardware sales driving point, this serves as exceptional entry points for increasing their digital sales channels. The company knows this is their higher margin business for this segment, so I’m happy to see them using their technology to their advantage to boost these sales channels.

Digital revenues for Sony at March’s Fiscal Year end in 2021 showed roughly $5 billion of its $25 billion in games and network services coming from digital software. That’s 20% of the total games and network services segment. Furthermore, we know digital channels hold higher margins in the majority of industries, so this will leave Sony feeling comfortable with a growing operating margin into the future.

Okay, so we’ve got four nice stones for our lovey David. Now we just need a slingshot to launch our stones straight into Goliath’s forehead.

Simple, that slingshot is the PlayStation 5.

The Slingshot

As you have likely noticed, all of the value effects listed before start with one driver: hardware sales. That’s not a coincidence. The PlayStation 5 is a powerful console for Sony to increase their gaming and network segment. With the growth in this console, I see the stones as lagging, but growing proportionally with the console sales.

The Popularity Of The PlayStation 5

PlayStation 5 is already the fastest selling console in gaming history. By October 23, 2021, it sold 13.8 million units worldwide. That’s in less than a year. To put in comparison, this figure is greater than the Wii U’s 13.56 million lifetime sales.

Ironically, the console has been out of stock since the start of its launch. The head of Xbox, Phil Spencer, cites, “When you think about trying to go get an Xbox or a new PlayStation right now in the market, they’re really hard to find. And it’s not because supply is smaller than it’s ever been. Supply is actually as big as it’s ever been. It’s that demand is exceeding the supply for all of us. Therefore, it’s reasonable to assume these numbers are not accurate representations of the demand, and that, when more consoles come online, growth will continue.

In comparison, there is no official remark from Xbox to display their official sales. However, the head of Xbox, Phil Spencer, has stated, “At this point, we’ve sold more of Xbox Series X|S than we had any previous version of Xbox.”

According to senior analyst Daniel Ahmed, the Xbox Series X|S has shipped roughly 12 million consoles since its inception.

| Gaming Console | Units Sold After One Year(millions) |

| PlayStation 5 | 13.8 |

| Xbox Series X and Xbox Series S | 12 |

Now, for a company with a growing content library and all the money in the world, why haven’t they taken over PlayStation 5’s unit sales, at least on estimates? Shouldn’t they be growing much more quickly, considering all that it represents? The answer is no.

We have to remember that PlayStation 5 offers something completely unique. Refer to stone 2 or stone 4. It boasts a new dimension of gameplay with haptic feedback and a new, next-gen level UI. Furthermore, stone 1 offers unparalleled gameplay experiences driven by next-level narrative performances, all only playable on the PlayStation 5. The next step for PlayStation 5 is leveraging stone 3’s potential, driving its growth by bringing it on par with its other segments in this category. Something I see becoming increasingly more likely.

The Bottom Line

Microsoft might be the big, tall giant in the spotlight right now. However, Sony is keeping to its strategy, building long-lasting organic growth, first, through the sale of its flagship product, the PlayStation 5, and allowing that effect to trickle into its core strategies (the 4 stones). The company’s revenues grew nearly 30% last quarter, showcasing its power despite keeping quiet. Sony doesn’t need to be loud because, like David, they are exceptionally confident in their brand and the content they produce.

I believe its competitive advantages will drive long term revenue growth and profitability through further driving the sales of the company’s hardware and exploiting these digital channels. When digital channels are exploited, operating margins improve. Therefore, I expect Sony to greatly improve on this aspect.

So what’s the catalyst? Why buy Sony?

Sony’s growth in the gaming and network segment is being halted by the limited supply of its flagship product. The stones can’t perform unless the PlayStation 5 continues its growth. We know that supply will eventually open up, and when it does, I’m certain we will witness something on a David and Goliath scale of what’s possible.

Be the first to comment